The Main Principles Of San Diego Home Insurance

The Main Principles Of San Diego Home Insurance

Blog Article

Safeguard Your Home and Liked Ones With Affordable Home Insurance Program

Relevance of Affordable Home Insurance Coverage

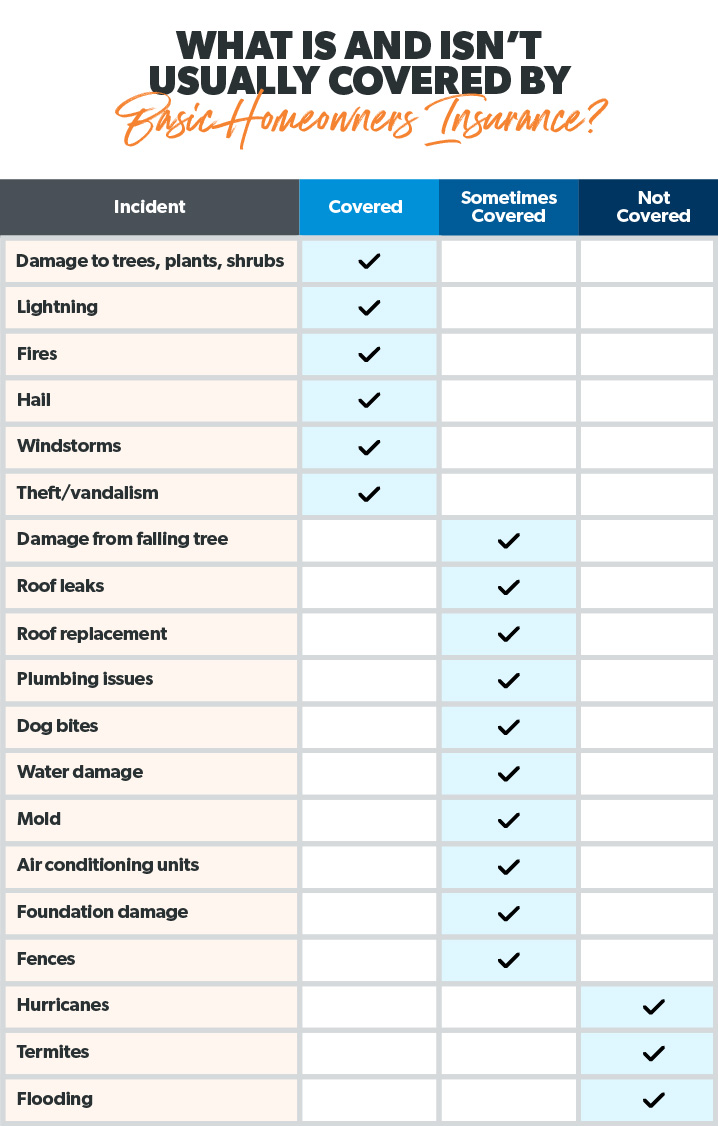

Safeguarding economical home insurance is critical for safeguarding one's home and financial health. Home insurance supplies security against different dangers such as fire, burglary, natural disasters, and personal responsibility. By having a thorough insurance policy plan in position, property owners can feel confident that their most considerable investment is shielded in the event of unanticipated circumstances.

Budget-friendly home insurance not only provides economic safety and security however likewise provides tranquility of mind (San Diego Home Insurance). Despite increasing property values and building expenses, having a cost-efficient insurance policy makes certain that house owners can conveniently restore or repair their homes without facing considerable financial burdens

Furthermore, cost effective home insurance policy can likewise cover individual items within the home, using reimbursement for items harmed or stolen. This protection prolongs beyond the physical framework of the house, securing the contents that make a home a home.

Coverage Options and Boundaries

When it pertains to protection limits, it's vital to comprehend the optimum amount your plan will pay for each and every kind of coverage. These restrictions can vary depending on the policy and insurance company, so it's important to assess them carefully to guarantee you have adequate protection for your home and assets. By understanding the protection choices and restrictions of your home insurance plan, you can make educated decisions to guard your home and loved ones properly.

Factors Impacting Insurance Coverage Expenses

Numerous variables significantly affect the prices of home insurance policies. The area of your home plays an important role in establishing the insurance coverage costs.

In addition, the sort of insurance coverage you choose straight influences the cost of your insurance coverage. Deciding for added insurance coverage options such as flood insurance policy or quake protection will boost your premium. Picking greater coverage restrictions will certainly result in higher prices. Your insurance deductible quantity can likewise impact your insurance expenses. A greater insurance deductible usually suggests lower costs, yet you will certainly have to pay even more out of pocket in case of a claim.

In addition, your credit report, declares background, and the insurer you select can all affect the rate of your home insurance coverage. By thinking about these variables, you can make informed decisions to help manage your insurance policy sets you back properly.

Contrasting Quotes and Carriers

Along with contrasting quotes, it is critical to assess the online reputation and monetary stability of the insurance coverage companies. Seek client evaluations, ratings from independent companies, and any type of history of complaints or regulatory actions. A trustworthy insurance coverage copyright need to have a great record of promptly processing claims and supplying superb client service.

Additionally, think about the specific protection attributes provided by each company. Some insurance companies may offer extra benefits such as identification burglary security, equipment failure protection, or coverage for high-value things. By meticulously comparing companies and quotes, you can make an informed navigate to this website choice and select the home insurance policy plan that best fulfills your needs.

Tips for Saving on Home Insurance

After extensively contrasting quotes and providers to locate the most ideal insurance coverage for your requirements and budget plan, it is prudent to discover efficient methods for conserving on home insurance. Numerous insurance policy firms supply price cuts if you buy multiple plans from them, such as combining your home and car insurance coverage. Frequently evaluating and updating your policy to mirror any type of changes in your home or this website scenarios can guarantee you are not paying for coverage you no longer demand, helping you save money on your home insurance coverage costs.

Verdict

In final thought, securing your home and loved ones with inexpensive home insurance policy is essential. Understanding protection variables, choices, and limits impacting insurance coverage expenses can assist you make educated decisions. By contrasting suppliers and quotes, you can discover the most effective policy that fits your requirements and spending plan. Implementing ideas for reducing home insurance policy can likewise aid you safeguard the essential security for your home without damaging the financial institution.

By unraveling the intricacies of home insurance strategies and discovering functional approaches for protecting budget-friendly insurance coverage, you can guarantee that your home and enjoyed ones are well-protected.

Home insurance plans generally supply numerous protection alternatives to safeguard your home and possessions - San Diego Home Insurance. By recognizing the protection alternatives and limitations of your home insurance coverage plan, you can make enlightened decisions to guard your home and enjoyed ones efficiently

Regularly assessing and updating your plan to mirror any type of changes in your home or circumstances can ensure you are not paying for protection you no longer click to find out more demand, helping you save cash on your home insurance costs.

In verdict, protecting your home and loved ones with inexpensive home insurance policy is essential.

Report this page